Given the economy is expected to keep improving, and sustained likely by infrastructure spending, we should see greater demand for rental property. In our last report last summer, rent prices had reached a 5% to 6% growth rate is pushing toward 15% now. Short Term Renters Will Likely Become Long Term Tenants See more of Zumper’s 2021 report: /blog/zumper-2021-annual-rent-report and read up on the single family rental market. 1 bedroom rent prices dropped in December (Omicron fears in buildings?) but also rose 12% in 2021. Zumper’s year end rent report shows 2 bedroom rent prices rose 13% throughout the year. That is good news for landlords who went through some very tough times in 2020/2021. Both one and two bedroom rental prices are up about 12 to 15% since last November. This chart from Zumper shows rent rose swiftly in 2021 and appears to have moderated in November. Work from home is expected to be continuous (companies need cheaper labor, and workers need cheaper rent). Although a trend to back to the city is filling up apartments, the demand in pandemic destination cities is staying healthy too. Those hoping for a lull in the rising price trend will likely be disappointed. Given the economic recovery is progressing, while labor and materials shortages, evictions laws terminated, and property prices are increasing, there is little to support any prediction other than rising rent prices whether in California, Texas, Florida or Massachusetts.

Renters are asking if rent prices will fall and landlords wonder if they’ll rise. However, new rental management challenges are appearing and tenants have greater expectations of their landlords and their rental experience. That rise may encourage more house and apartment developments. NAR predicts rent prices will rise faster than home prices, at 7.1% clip in 2022. Learn more.įor landlords, it looks like the rental market has improved greatly with rent prices rising fast in 2021. Rent Prices Rising - Will Draw in Rental Investment Land and materials are in short supply and labor is a struggle for builders. Falling Fed stimulus (bond buying), rising interest rates, and soaring inflation could upset the economy creating volatility shocks, and rising taxes and housing regulations could discourage building. Despite that, the housing market should provide opportunities for smart rental investors.įear factor: Perhaps the key worry going into 2022/2023 is the economy. Interest from interested buyers is waning due to the price, and should mortgage rates rise further (they rose last month), sales will surely stall. NAR forecasts that house prices may moderate in 2022 to perhaps 6.6% growth (although Zillow forecasts at 13.9% increase in the next 12 months), yet houses/townhouses are still not affordable for most Americans.

RENTAL PROPERTY TRACKER PLUS REVIEW FULL

We’ve looked into the built for rent market and although it’s a small piece (6% of the total market) of the full housing market, it’s share should increase. According to NAHB data, there were 16,000 starts on single-family home units in the 3rd quarter 2021. Built for rent homes is one such area that may offer premium profitability. Rental house properties look to be the belle of the ball with immense upside in profitability. Real estate investors and the investment community are turning their attention to rental market (single family and multifamily). See more info on the California housing market. Let’s take a deeper dive into the US rental market to understand demand drivers, best opportunities, and the outlook for apartment rentals, house rentals and multifamily units. The stats and momentum suggest the opposite, that rent prices will grow perhaps at a slower rate. Renters continue to ask if rent prices are going to drop?.

RENTAL PROPERTY TRACKER PLUS REVIEW SOFTWARE

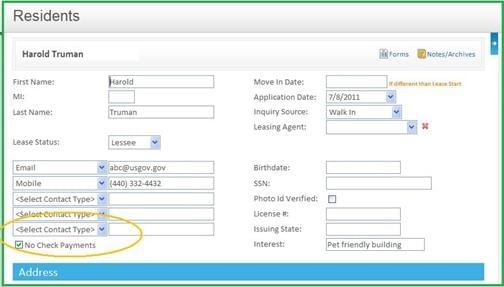

Growth in investment and in new rental property portfolios will drive demand for property management companies and new software technology in the second half of 2022 and in 2023.Įnjoy further insights in this State of the Rental Market Report for 2022 which includes stats, projections and forecasts from major data sources and experts. Low supplies, lower construction, and intense demand from buyers shut out of the purchase market should make rental property investment even more attractive compared to other opportunities.

After a rapid period of growth, new construction appears to be tapering off of late.Īn economic and housing market downturn would be unfortunate, however demand for rental property will not abate anytime soon. The US rental property market continues to change.

0 kommentar(er)

0 kommentar(er)